| « The Weight of Coal | Politicians Choosing Voters » |

Feature Mon Apr 04 2011

Not a Wonderful Life: The Effects of Aggressive Foreclosure

Zabrina Worthy frets when she talks about losing her house. She never saw how it could happen to her the way it did. Her voice cracked with tears at the first words she spoke to me, over the telephone: "I completely lost everything I had." When they boarded her house, she didn't just lose her home. Her computer, her furniture, her business — all the things she and her three children owned — were locked inside.

Zabrina Worthy frets when she talks about losing her house. She never saw how it could happen to her the way it did. Her voice cracked with tears at the first words she spoke to me, over the telephone: "I completely lost everything I had." When they boarded her house, she didn't just lose her home. Her computer, her furniture, her business — all the things she and her three children owned — were locked inside.

Zabrina stands about 5'8". She's 36, her face is round and coffee-colored, and when I visit her, she often smiles, in spite of her ordeal. She bought the two-story bungalow at 72nd and Sawyer in Chicago Lawn for just over $200,000 in 2004, and moved there with her three children after divorcing her second husband.

By 2008, she was making $4,000 a month, filling two jobs — nights as a security guard at McCormick Place and days as a school bus driver. She needed to keep both jobs till her small business transporting social service clients for the state of Illinois got off the ground. She employed her son, Bruce, and her new husband to drive two vans, chauffeuring her customers. "The transportation business could have been big. Chicago is a big place — they are overloaded getting people around," she said.

By the summer of 2008, the money from her business loan ran out, and the state had fallen three months behind in paying her. In August, her Wells Fargo home loan suddenly shot up from $1,500 to about $2,200, and she couldn't make up the difference. That fall, she put her house on the market, and she says she tried to get Wells Fargo to modify her loan. She geared herself for a move she did not want to make.

One morning in December 2008, four months later, the kids left for school, and she left to drive her school bus route. When Zabrina came home from work, her windows were boarded up, the locks on the doors were changed; she had no way to get in. "When I left, I just had my clothes on my back for work," she says. Her two younger children were left in their school uniforms. Her computers and paperwork for her business were also lost inside. "I had never been homeless in my life, but after that, I was." They never lived in the house again.

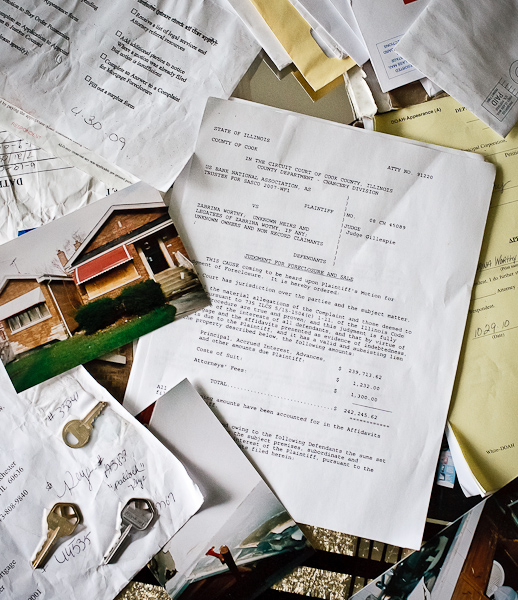

The sheriff had never sent anyone to evict Zabrina and her family. Wells Fargo never obtained a court order for foreclosure or eviction, and Zabrina said the bank had sent her just one notice of late payment. A private process server had been sent to give her notice of a pending foreclosure, but he didn't give her proper notice, settling instead for the boyfriend of her sister in Park Forest. Wells Fargo showed me photos of the house before the board up, with the windows open or broken out. "The house appeared to be abandoned," said Wells Fargo spokesman Tom Goyda. "Obviously, there's a difference of account."

Last fall, three major banks — GMAC, J.P. Morgan Chase and Bank of America — suspended their foreclosures after they admitted to falsifying affidavits, often with notorious "robo-signers." Robo-signers are low-level banking executives who robotically notarized foreclosure affidavits by the thousands, without any review of the accuracy of the mortgage documents, as required by law.

Last October Cook County Sheriff Tom Dart imposed a moratorium on evictions from those banks — his second reprieve in as many years. Zabrina's attorney, Kelli Dudley, said she had 10 clients in Cook County who lost their homes from improper foreclosures. Reports have come from across the country of people finding their houses boarded up with no order of eviction. In Michigan, a man found his property boarded up even though he paid cash for his house. They got the wrong address.

Foreclosure in Illinois may take years and requires a rigorous due process. A bank must first get a judge's order for foreclosure under the Illinois Mortgage Foreclosure Law. Once ordered, the homeowner has seven months to reconcile with the bank before an eviction order can be served. After the eviction order is granted, the homeowner still has 30 days to leave with all of his or her stuff. And only the sheriff can order people out. Dudley, who coordinates the predatory lending program at John Marshall Law School, said the bank failed to get any of these orders on Zabrina's house or follow any due process.

"It's not like It's a Wonderful Life anymore," said Michael van Zalingen, a mortgage attorney who has worked for the Chicago homeowner advocacy group, Neighborhood Housing Services. Van Zalingen said large banks today seldom hold the risk for the mortgages they loan. If you hold a mortgage from a megabank like Chase or Wells Fargo, chances are it's been sold on Wall Street and bundled up with a bunch of other loans as a "mortgage-backed security" and another bank is hired to act as trustee. Wells Fargo remains as only the servicer of a loan and does not get stuck with the loss if you don't pay.

At Bailey Building & Loan Association in mythical Bedford Falls, all of the bankers were under one roof, and George Bailey knew all his customers personally. This is a business model community banks still hold. "They don't seem to have these problems," van Zalingen said. "A community bank owns its loans. They would have to answer to depositors and the FDIC." But as he explains it, when megabanks service a mortgage, they divide their foreclosure and property management duties into separate departments often spread out over different states — with little communication between them. "There's this saying that banks are too big to fail, but they're really too big to succeed," van Zalingen said. A judge or a bank's attorney might tell its foreclosure division to cease a foreclosure order. But, he said, word might not get to its property management division, and the bank will continue to board up a home and prepare it for sale.

Zabrina's family spent the winter couch-surfing across Cook County. In the spring, Zabrina gave up on Chicago and moved her family to Valparaiso, Ind., hoping to make a new start. Her attorneys filed a motion to quash the foreclosure proceedings, which a judge ordered in April 2009, based on the invalid forms of the private process servicer. The bank's attorneys did not contest. She was given her keys and let back in her house.

In 2010, Dudley teamed up with the Progressive Law Group in downtown Chicago and Zabrina's case was made part of a class-action lawsuit against U.S. Bank, the trustee of the mortgage-backed security that owns Zabrina's mortgage. They launched a seven-count counterclaim against the banks, alleging misdeeds from trespassing to unlawful conversion of property to consumer fraud.

If a house is abandoned, the bank is supposed to send someone to board up the home, secure the premises and winterize it so the place can be sold. But in Zabrina's house, the pipes froze and flooded the lower levels of the house. Squatters took up residence in Zabrina's second-floor bedroom and trashed the place.

At first, many of her things were still there, if ruined. But in April 2010, a year after the court order to stop foreclosure, representatives of Wells Fargo came back, gutted the first floor and removed the stairs to the basement. The Wells Fargo spokesman said repairs had been made to fix the water damage from when the pipes broke the first winter. After this work, all of Zabrina's furniture and appliances on the first floor were gone, and the interior walls of the house were piled in the lawn for trash. The city fined her $2,000 for the nuisance.

"The zeal with which some of these banks and the offices that represent them go after these homes is unbelievable," Sheriff Dart said. "When you tell me about specific cases, I'd love to say this is an oversight, but I think they just don't care." He said after he suspended foreclosure evictions due to the robosigning scandal, he tried to get the banks' attorneys to sign a two-page paper stating that all of their documents in the foreclosure filings were legal. "I did not get one to sign it," he said. "It's absurd, merely to state something is legal."

The financial crimes unit of his office launched an investigation into the flood of foreclosures coming from the banks. In an initial sampling of foreclosures, 70 percent were found to be conducted by robo-signers, many of whom never read what they were signing. "This is out and out lying. There's people saying they've signed these documents, but they've never looked at them," Dart said. He said if they say that in court, it's perjury. "This isn't 'we put on the white cover instead of the blue cover' -- you lied in court."

Dart said he felt the banks were just waiting him out. On Nov. 19, 2010, Dart was forced by the state's attorney to end the moratorium and follow judicial orders to evict people from homes, regardless of whether the affadavits had been administered lawfully.

The streets south of Marquette Park smell like baked cookies, with the wind wafting over from the giant Nabisco bakery on South Kedzie. Jets descend overhead to land at Midway Airport. The last leaves of autumn rattle against the little bungalows, each a little different, but most with steep gable roofs. Zabrina's house is the only one on her block that's boarded up. Chicago Lawn appears peaceful on the outside, not wracked by a foreclosure crisis.

Numbers tell a different story. In three years, the four zip codes around Marquette Park saw 8,700 foreclosures. In 2006, the median sales price in Chicago Lawn was $220,000; in December 2010, it was $63,000. The banks would lose money trying to resell the homes in the current market. But if banks don't own the loans they service, they don't take the loss if homeowners default. Van Zalingen explained that mortgage-servicing banks can charge fees to the trustee holding the mortgage. If the investors want to hold onto their asset, they'll have to pay the servicer to hire foreclosure attorneys and a board-up company to manage the vacant home. "There's a lot of money to be made in foreclosures on the houses you service for someone else," he said.

Van Zalingen surveyed 3,300 Chicago homeowners who came to Neighborhood Housing Services to avoid foreclosures in 2008 and 2009. He found 40 percent of the homeowners couldn't afford their homes, regardless of loan modification. But 60 percent of homeowners could keep their homes if the banks would modify the interest or lower the principle to real market value. Zabrina fell squarely into the latter group — if her principal were lowered closer to real market value, she could afford the loan.

I first met Zabrina at the house on Sawyer Avenue this past autumn. Plywood covers the first-floor windows and an ADT security sign sits in the overgrown bushes. Cans of Old English lay on the stoop. I arrived before her, and the back door was open, but I wouldn't go inside, afraid of who or what might be in there. Zabrina came with her son Bruce, 19, in the old Buick Century he bought to get himself to work at Wal-Mart. Bruce is a lanky guy in glasses with an easy smile. He recovered some big speakers and an Atari gaming system while Zabrina showed me the house.

We entered the house and climbed the spooky stairs to the second floor. The first floor was pitch-black and everything gone, down to the studs. The walls of the second floor were covered with graffiti — "666" and gang signs. A single black nightgown hung from the ceiling. Papers, wrappers, bottles blanketed the floor, along with used condoms and hypodermic needles. "They were having sex on that bed," Zabrina said. "As you can tell, someone was living here." Clothes, hers and someone else's, were scattered about the room. At the center of her mattress sat a candle burned down to nothing with tinfoil beside it, likely for drug use. In the foul-smelling bathroom, shaved hair covered the sink and a needle sat on the counter, waiting to prick.

In October, Zabrina appealed her $2,000 nuisance citation with the city of Chicago and appeared before administrative law judge Deidre D. Cato at Jeffery and 95th Street. She was being held liable after the bank gutted her house and dumped all the boards and trash in the lawn. Cato, flanked by Chicago city flags, acts much like Judge Judy, dismissing cases or, more likely, affixing penalties on the spot. "If you sit here and listen to the cases, most people will give them everything. It's all about making revenue," Zabrina whispered to me. The five appellants that went before her all lost. But Zabrina had her foreclosure papers ready to give the judge. "I do find the city has failed to provide the proper evidence," Cato said. "I find that you are not responsible."

The case dismissed, Zabrina Worthy left with her father, Halbert Worthy, 68, a burly man with rough-worn hands who worked at a South Side coffee factory till it closed in 1986. Her parents have been married 50 years and live in the same house in West Englewood where she grew up with her three siblings. "You don't ever see any of my kids in the street," Halbert said. "I'm her father — when she's got a problem, I try to help her out."

On Nov. 16, the Cook County chancery court denied a motion by the banks' attorneys to dismiss her lawsuit against them. A trespassing claim against the banks stood entirely. The other claims against the banks were dismissed without prejudice, but Zabrina Worthy's attorneys refiled them on Jan. 6. The attorneys for the banks moved to reject the claims once again on Feb. 22, but the case will be continued until at least June.

Sheriff Dart said his office is still working with law students at his alma mater, Loyola Law School, to comb through the roughly 1,000 foreclosure orders that have reached his office, and he anticipates criminal charges.

The sheriff said he saw little recourse for people who were illegally booted from their homes in the foreclosure mess. "In theory, they could proceed with some civil actions, but all in theory," he said. "The vast majority are not law students. Most people are just left scrambling. I don't know what to tell them. I just don't."

He said he was faced in January to comply with a judge's eviction order on a house in Northbrook where he knew the documents had been filed improperly. He initially refused to carry out the eviction and the judge threatened him with contempt. He said he relented only when he learned the family had already vacated the home. "I wasn't going to fight that," Dart said. "I'll wait until there's a family involved."

Zabrina has a car and a job in Indiana, but her current position also doesn't offer medical benefits. She hopes someday to own a home again, and maybe start another transporting business.

She told me that I awoke something in her father the day I showed up at court. They had not spoken of her eviction for months. After we parted, they skipped lunch, and he drove to her old house on a whim. "He was saying how proud he was of me. Everything I've done, even if it didn't work out, I keep trying.

"I don't give up."

Christopher David Gray is a freelance journalist in Chicago. Michael Boyd is an editorial photographer based in Chicago.

This feature is supported in part by a Community News Matters grant from The Chicago Community Trust and the John S. and James L. Knight Foundation. More information here.

Donna / April 4, 2011 3:24 PM

Wells Fargo has proven in our case that its business is built on fraud.

In 2005, Wells Fargo originated us a fraudulent mortgage loan.

In 2010, Wells Fargo knowingly wrongfully foreclosed our home.

Now, Wells Fargo is falsifying 1099 form to further defraud us and taxpayers to write off tax of its fraudulent mortgage loan.

In its first version of 1099 form, Wells Fargo listed Freddie Mac as mortgage lender, which Freddie Mac confirmed in writing that it is not the mortgage lender.

In its second version of 1099 form, Wells Fargo listed Wells Fargo as mortgage lender, which it has already confirmed in writing that it sold its fraudulent mortgage loan to a pool of investors.

Please sign the petition www.wellsfargomortgagefraud.com Join the fight to break up 'too big to fail' banks. Demand criminal investigation and criminal prosecution of fraud perpetrated to this great country and its people.